Halal Mortgages in Canada: Everything You Need Know

The Canadian government’s recent announcement to explore new measures for expanding access to alternative financing products, such as halal mortgages, marks a significant step towards inclusivity in the country’s financial services sector. This initiative acknowledges the unique needs of Canadians who adhere to Islamic finance principles, which prohibit interest or “Riba” in financial transactions. In this comprehensive guide, we delve into the world of halal mortgages, outlining their basis, types available in Canada, the current state of halal mortgages, and the impact of federal policies on these financial products.

Introduction to Halal Mortgages

Halal mortgages offer a way for individuals of the Islamic faith to finance homes without compromising their religious beliefs. Islamic finance upholds that money itself should not generate extra value; hence, the traditional concept of interest conflicts with these principles. The federal government’s willingness to engage with financial service providers and diverse communities signals a promising step towards accommodating the needs of all Canadians aspiring to homeownership.

The Basis of Halal Mortgages

At the core of halal mortgages is the Islamic finance principle that prohibits the charging of interest, known as Riba. This principle distinguishes Islamic financial products, including mortgages, from their conventional counterparts. Unlike traditional mortgages where the interest payment is a primary component, halal mortgages adopt alternative structures to comply with Shariah law. The stance on usury is not unique to Islam; other Abrahamic faiths like Judaism and Christianity also regard the practice as sinful, albeit Islamic finance institutions have developed unique solutions to this issue.

Types of Halal Mortgages Available in Canada

Canada offers three main types of Shariah-compliant mortgages: Murabaha, Ijara, and Musharaka. Each model employs a different method for facilitating homeownership without resorting to interest charges:

- Murabaha (Cost-Plus Financing): This structure involves the financial institution purchasing the property and selling it to the borrower at a profit, with payments made in installments. The profit margin is agreed upon upfront and remains fixed throughout the term of the mortgage.

- Pros: Fixed payments and clear cost structure.

- Cons: Limited flexibility in terms negotiation.

Murabaha mortgages are popular among Canadian Muslims due to their straightforward structure and adherence to Islamic principles. The fixed payments and clear cost structure provide borrowers with transparency and predictability. However, the limited flexibility in terms negotiation may be a drawback for some borrowers who prefer more customizable options.

- Ijara (Lease to Own): Under this arrangement, the bank purchases the property and leases it to the borrower for an agreed-upon period. The lease payments contribute towards eventual ownership, and at the end of the lease term, the borrower has the option to purchase the property at a pre-determined price.

- Pros: Flexibility and potential tax benefits.

- Cons: Possibility of higher overall cost.

Ijara mortgages offer flexibility for borrowers who may not be ready to commit to full ownership immediately. The lease period provides the opportunity to assess the property and financially prepare for homeownership. Additionally, lease payments may be tax-deductible in certain situations. However, borrowers should consider the possibility of higher overall costs compared to traditional mortgages.

- Musharaka (Declining Balance Co-Ownership): This method establishes a partnership between the borrower and the bank, where both parties contribute to the purchase and share ownership. Over time, the borrower buys out the bank’s share, eventually becoming the sole owner of the property.

- Pros: Shared risk and potential for appreciation benefits.

- Cons: Complexity in agreement terms.

Musharaka mortgages provide an opportunity for shared ownership between the borrower and the bank, mitigating the risk for both parties. This shared risk also means shared appreciation benefits when the property value increases over time. However, the complexity of the agreement terms may require more extensive legal and financial understanding.

Comparison Table of Types of Halal Mortgages:

| Type | Structure | Pros | Cons |

|---|---|---|---|

| Murabaha | Cost-Plus Financing | Fixed payments, clear cost | Limited negotiation flexibility |

| Ijara | Lease to Own | Flexibility, potential tax benefits | Possibility of higher overall cost |

| Musharaka | Declining Balance Co-Ownership | Shared risk, appreciation benefits | Complexity in agreement terms |

The Current State of Halal Mortgages in Canada

Despite the availability of halal mortgage options from certain financial institutions, none of Canada’s five “Big Banks” currently offer them. This gap highlights a significant market opportunity and consumer demand for such products, especially among Canada’s growing Muslim population.

Financial Institutions Offering Halal Mortgages

While the “Big Banks” do not offer halal mortgages, several other financial institutions in Canada have recognized the demand and cater to it. Examples of these institutions include Islamic financial institutions like Amanah Finance and UM Financial, as well as credit unions like Alterna Savings and Vancity. These institutions have created specific halal mortgage products to serve the needs of Muslim Canadians seeking Shariah-compliant financing options.

The Position of Canada’s Five “Big Banks”

The decision by Canada’s five “Big Banks” to not offer halal mortgages raises questions about the level of inclusivity within the financial sector. However, it is important to note that the “Big Banks” have taken steps to accommodate the needs of Muslim Canadians in other ways, such as offering Islamic savings accounts and investment products. Nevertheless, the absence of halal mortgages from their product offerings highlights the potential for further growth and development in this area.

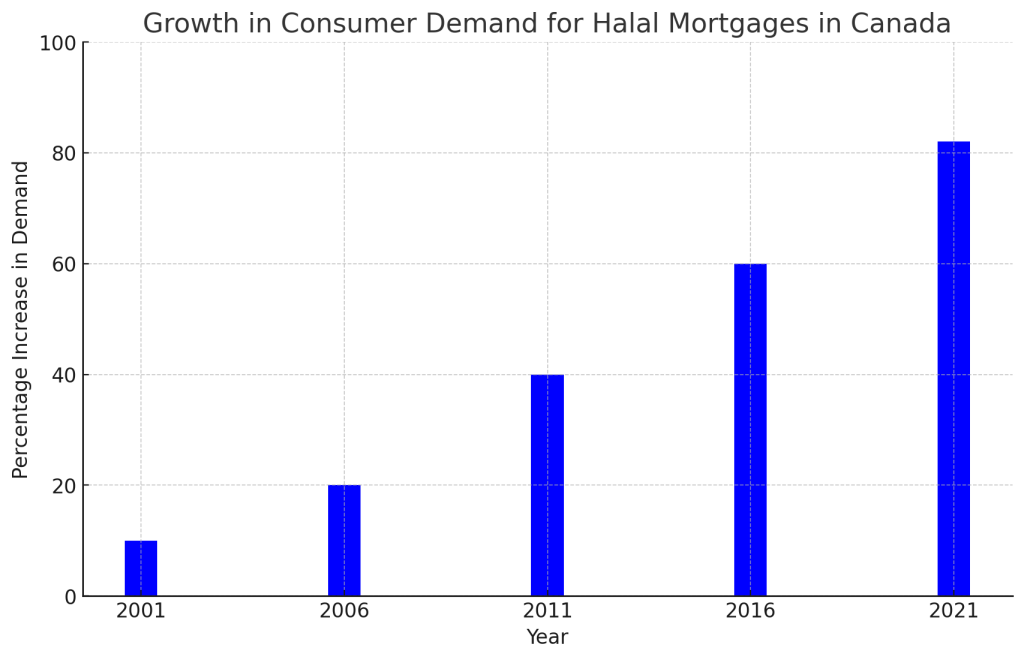

Market Analysis and Consumer Demand

The demand for halal mortgages in Canada is steadily increasing, driven by the growing Muslim population and their desire to align their financial choices with their religious beliefs. According to the National Household Survey conducted by Statistics Canada in 2011, the Muslim population in Canada increased by 82% between 2001 and 2011. As the Muslim community continues to grow, so does the demand for financial products that cater to their needs.

Navigating the Halal Mortgage Process

The process for securing a halal mortgage involves specific eligibility criteria, documentation, and legal considerations unique to Islamic finance. Prospective homeowners should prepare for a comprehensive assessment of their financial health and alignment with the principles of Shariah-compliant financing.

Eligibility and Application Process

The eligibility criteria for halal mortgages may vary slightly depending on the financial institution offering the product. Generally, applicants are required to meet the same basic requirements as traditional mortgages, such as having a good credit score, a stable income, and a down payment.

The application process for a halal mortgage typically involves the following steps:

- Initial consultation: The borrower meets with a representative from the financial institution to discuss their financial situation, the specific requirements of the halal mortgage, and the available options.

- Pre-approval: If the borrower meets the initial criteria, they may receive a pre-approval letter indicating the maximum amount they can borrow.

- Property selection: The borrower finds a suitable property and provides the necessary details to the financial institution.

- Property valuation: The financial institution assesses the value of the property to determine its suitability for financing.

- Agreement drafting: Once the property is approved, the financial institution prepares the necessary agreements, such as the Murabaha agreement for a Cost-Plus Financing mortgage or the Ijara agreement for a Lease to Own mortgage.

- Agreement signing and closing: The borrower and the financial institution sign the agreements, and the mortgage is closed.

Documentation and Legal Considerations

When applying for a halal mortgage, prospective homeowners should be prepared to provide the following documents:

- Proof of identity (e.g., passport, driver’s license)

- Proof of income (e.g., employment letter, pay stubs, bank statements)

- Proof of down payment (e.g., bank statements)

- Property details (e.g., purchase agreement, property appraisal)

It is crucial to carefully review the agreements and seek legal advice if necessary to ensure a clear understanding of the terms and conditions associated with the halal mortgage.

Tips for Prospective Homeowners

Navigating the halal mortgage process can be overwhelming, especially for first-time homebuyers. Here are some tips to help prospective homeowners:

- Research financial institutions: Take the time to research and compare different financial institutions offering halal mortgages to find the one that best suits your needs and preferences.

- Seek professional advice: Consult with a knowledgeable Islamic finance advisor or lawyer who can provide guidance and ensure that the halal mortgage aligns with your religious beliefs and financial goals.

- Understand the terms and conditions: Carefully review the agreements and seek clarification on any terms or conditions that you do not fully understand. It is important to be fully aware of all the obligations and responsibilities associated with the halal mortgage.

- Plan for additional costs: In addition to the mortgage payments, consider other costs associated with homeownership, such as property taxes, insurance, and maintenance expenses. Proper financial planning will help ensure that you can comfortably afford your home.

- Stay informed: Keep up-to-date with changes in the halal mortgage market and federal policies that may impact the availability and accessibility of these financial products. Being informed will empower you to make informed decisions and take advantage of any new opportunities.

Challenges and Considerations

While the interest in halal mortgages is growing, several challenges and considerations need to be addressed to further promote their availability and accessibility.

Regulatory Hurdles and Financial Risks

One of the primary challenges in the development of halal mortgages is navigating the regulatory framework. Financial institutions offering halal mortgages must comply with existing regulations while also adhering to the principles of Islamic finance. This requires collaboration between financial institutions, regulators, and Islamic scholars to ensure compliance and mitigate financial risks.

Lack of Awareness and Misconceptions

A significant challenge in promoting halal mortgages is the lack of awareness and misconceptions surrounding Islamic finance. Many individuals, including potential borrowers, have limited knowledge about the principles and benefits of halal mortgages. Increasing awareness through educational initiatives and community outreach programs can help address these misconceptions and foster trust in the halal mortgage market.

Potential Solutions and Future Outlook

Addressing the challenges associated with halal mortgages requires collaborative efforts from various stakeholders, including government bodies, financial institutions, and community organizations. Potential solutions and future outlook for halal mortgages in Canada include:

- Increased collaboration: Enhanced collaboration between financial institutions and government bodies can lead to the development of more standardized regulations and guidelines for halal mortgages.

- Educational initiatives: Investing in educational initiatives and awareness campaigns can help educate the public about halal mortgages, dispel misconceptions, and promote their benefits.

- Market expansion: As the demand for halal mortgages continues to grow, there is an opportunity for financial institutions, including the “Big Banks,” to enter the market and offer these products. This expansion would provide broader access to halal mortgages for a larger segment of the population.

- Innovation and product development: Continued innovation and product development can lead to the introduction of new and more flexible halal mortgage options, catering to the diverse needs of Muslim Canadians.

The Impact of Federal Policies on Halal Mortgages

The federal government’s recent budget announcements and consultations with financial services providers indicate a positive shift towards supporting diverse homeownership needs. How these policies unfold could significantly influence the landscape of halal mortgages in Canada, making homeownership more accessible and inclusive.

Recent Budget Announcements and Their Implications

The federal government’s commitment to exploring measures for expanding access to alternative financing products, including halal mortgages, demonstrates a recognition of the importance of accommodating diverse financial needs. Budget announcements may include incentives or measures to encourage financial institutions to offer halal mortgages, such as tax incentives or loan guarantees.

Consultations with Financial Services Providers

The federal government’s consultations with financial services providers play a crucial role in understanding the challenges and opportunities associated with halal mortgages. These consultations allow for a collaborative approach in developing policies and regulations that support the growth and accessibility of halal mortgages.

How Policies Could Support Diverse Homeownership Needs

Federal policies can play a significant role in supporting diverse homeownership needs, including the availability and accessibility of halal mortgages. Policies that encourage financial institutions to offer halal mortgages can expand options for Muslim Canadians and promote inclusivity in the housing market. Additionally, policies that provide incentives for the development of affordable housing options compatible with Islamic finance principles can further enhance accessibility for all Canadians.

Conclusion

The exploration of halal mortgages in Canada represents an essential step towards recognizing and accommodating the diverse financial needs and ethical considerations of Canadian homeowners. As the federal government and financial institutions continue to engage with this initiative, the future of halal mortgages in Canada looks promising, with the potential to offer more Canadians the opportunity to own homes without compromising their faith.

By understanding the principles, types, challenges, and policy implications associated with halal mortgages, prospective homeowners and stakeholders can navigate the evolving landscape of Islamic finance with greater insight and confidence. The continued dialogues and policies aimed at expanding access to these alternative financing products will undoubtedly play a pivotal role in shaping a more inclusive financial sector in Canada.