Introduction

Reverse mortgages have become an increasingly popular financial tool for Canadian homeowners aged 55 and older. These unique loans allow homeowners to access the equity in their homes without the need to sell or refinance. By borrowing up to 55% of the home’s value, reverse mortgages provide financial flexibility, particularly for those on fixed incomes. In this comprehensive guide, we will explore how reverse mortgages work in Canada, the eligibility criteria, the pros and cons, and much more. Whether you are considering a reverse mortgage for yourself or a loved one, this article will provide the detailed information you need to make an informed decision.

H1: What is a Reverse Mortgage?

A reverse mortgage is a loan that allows homeowners to convert part of the equity in their home into cash. Unlike a traditional mortgage where you make regular payments to the lender, with a reverse mortgage, the lender makes payments to you. The loan is repaid when the homeowner sells the home, moves out permanently, or passes away. This financial product is particularly suitable for homeowners who need cash but do not want to sell their home or take on the burden of monthly mortgage payments.

Key Features of a Reverse Mortgage:

- No Regular Payments Required: Unlike traditional loans, reverse mortgages do not require monthly payments. The loan balance, including interest and fees, is repaid when the home is sold or the homeowner moves out.

- Tax-Free Money: The funds received from a reverse mortgage are not considered income, so they are tax-free.

- Flexible Payment Options: Homeowners can choose to receive the funds as a lump sum, in regular installments, or as a combination of both.

- Homeownership Retained: Homeowners retain the title and ownership of their home.

Reverse mortgages offer a way to tap into the value of your home without the need to sell it, providing financial stability and flexibility during retirement years.

H2: How Do Reverse Mortgages Work in Canada?

Reverse mortgages in Canada work similarly to those in other countries, with a few specific regulations and features unique to the Canadian market. Here’s a step-by-step explanation of the process:

- Eligibility Assessment: Homeowners must be at least 55 years old and own and live in the home. The home must meet minimum value requirements, usually between $200,000 and $250,000.

- Application Process: The application involves an online estimate, followed by a detailed assessment considering the homeowner’s age, the home’s location, condition, and current value.

- Loan Approval: Once approved, the homeowner can borrow up to 55% of the home’s current value. The exact amount depends on various factors, including the homeowner’s age and the home’s value.

- Receiving Funds: Homeowners can choose how they want to receive the funds. Options include a single lump-sum payment, regular installments, or a combination of both.

- Interest Accrual: Interest rates on reverse mortgages are generally higher than traditional mortgages. The interest accrues over time and is added to the loan balance.

- Repayment: The loan is repaid when the home is sold, the homeowner moves out permanently, or passes away. The repayment amount includes the loan principal, accrued interest, and any fees.

Reverse mortgages provide a way for Canadian homeowners to access the equity in their homes without the need to sell or refinance. This can be especially beneficial for those on fixed incomes who need additional financial flexibility.

H2: Reverse Mortgage Providers in Canada

In Canada, two main providers dominate the reverse mortgage market: HomeEquity Bank and Equitable Bank. Both institutions offer similar products, but there are some differences worth noting.

HomeEquity Bank

- Established: 1986

- Products: CHIP Reverse Mortgage

- Availability: Directly and through major banks, credit unions, brokers, and financial planners

- Branches: No physical branches

Equitable Bank

- Established: 1970

- Products: Reverse Mortgage

- Availability: Through independent mortgage brokers

- Branches: No physical branches

Both HomeEquity Bank and Equitable Bank provide robust reverse mortgage options, but it’s essential to consult with a mortgage broker or financial advisor to determine which product best suits your needs.

H2: Types of Reverse Mortgages

There are different types of reverse mortgages available in Canada, each offering various features and payment options. Understanding these options can help homeowners make an informed decision.

Open or Closed Mortgages

- Open Mortgage: Allows for prepayment without penalties. Typically has a higher interest rate.

- Closed Mortgage: Offers a lower interest rate but includes prepayment penalties if the loan is paid off early.

Variable or Fixed Rates

- Variable Rate: The interest rate can fluctuate based on market conditions.

- Fixed Rate: The interest rate remains constant throughout the loan term.

Payment Options

- Lump-Sum Payment: The entire loan amount is received upfront.

- Regular Installments: Smaller, scheduled payments are made over time.

- Combination: A mix of an initial lump-sum payment followed by regular installments.

Each type of reverse mortgage comes with its own set of advantages and disadvantages. Homeowners should carefully consider their financial needs and consult with a financial advisor to choose the best option.

H2: CHIP Reverse Mortgage

The CHIP Reverse Mortgage is Canada’s oldest and most widely-used reverse mortgage product. It was rebranded in 2014 and is offered by HomeEquity Bank. The CHIP (Canadian Home Income Plan) Reverse Mortgage has been helping Canadian homeowners access their home equity for over three decades.

Key Features of the CHIP Reverse Mortgage:

- Age Requirement: Homeowners must be 55 years or older.

- Loan Amount: Up to 55% of the home’s current value.

- No Regular Payments: No monthly mortgage payments are required.

- Flexible Payout Options: Homeowners can choose to receive the funds as a lump sum, regular payments, or a combination of both.

- No Negative Equity Guarantee: Homeowners will never owe more than the home’s value at the time of sale.

The CHIP Reverse Mortgage is designed to provide financial stability and flexibility to Canadian seniors, allowing them to enjoy their retirement years without the stress of monthly mortgage payments.

H2: Who Can Get a Reverse Mortgage in Canada?

Eligibility for a reverse mortgage in Canada is determined by several factors. Understanding these criteria can help homeowners assess whether they qualify for this financial product.

Age Requirements

- Homeowners must be at least 55 years old.

- If the home is owned jointly, both homeowners must meet the age requirement.

Homeownership Requirements

- The home must be the homeowner’s primary residence.

- The property must meet minimum value requirements, typically between $200,000 and $250,000.

Factors Affecting Eligibility

- Age of the Homeowner: Older homeowners can generally borrow a higher percentage of the home’s value.

- Home’s Location: Properties in urban areas may qualify for higher loan amounts.

- Home’s Condition: The home must be well-maintained and in good condition.

- Current Value of the Home: The loan amount is based on the home’s current market value.

Independent Legal Advice Requirement

- Homeowners are required to obtain independent legal advice before finalizing a reverse mortgage. This ensures that they fully understand the terms and conditions of the loan.

Reverse mortgages are designed to help Canadian seniors access the equity in their homes while continuing to live in them. By meeting the eligibility criteria, homeowners can take advantage of this financial product to enhance their retirement years.

H2: How Much Can You Borrow with a Reverse Mortgage?

The amount that can be borrowed with a reverse mortgage in Canada depends on several factors. Here’s a detailed explanation of how the borrowing limit is determined:

Borrowing Limit

- Homeowners can borrow up to 55% of the home’s current value.

- The exact amount depends on the homeowner’s age, the home’s value, and its location.

Factors Affecting the Loan Amount

- Age of the Homeowner: Older homeowners can generally access a higher percentage of the home’s value.

- Current Value of the Home: Higher-value homes can qualify for larger loan amounts.

- Home’s Location: Homes in urban areas or desirable locations may qualify for higher loan amounts.

Example Scenarios

- Scenario 1: A 70-year-old homeowner with a home valued at $500,000 in a major city might qualify to borrow up to $275,000 (55% of the home’s value).

- Scenario 2: A 60-year-old homeowner with a home valued at $300,000 in a rural area might qualify to borrow up to $150,000 (50% of the home’s value).

The amount that can be borrowed with a reverse mortgage varies based on individual circumstances. Homeowners should consult with a mortgage broker or financial advisor to determine the exact amount they can borrow.

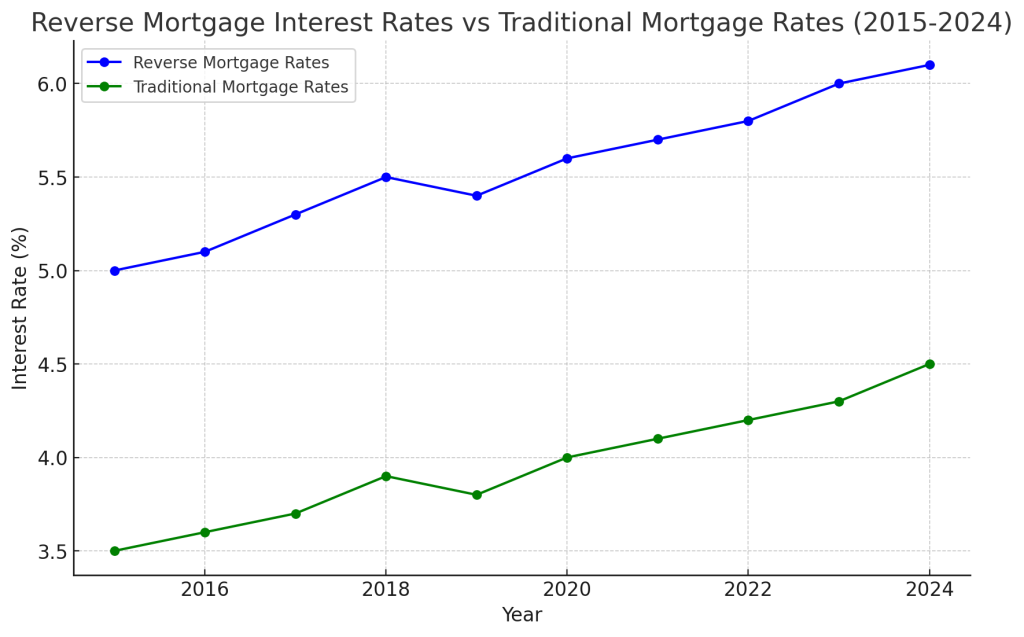

H2: Reverse Mortgage Interest Rates in Canada

Interest rates on reverse mortgages in Canada are generally higher than those on traditional mortgages. Here’s a detailed look at how these rates work:

Current Interest Rates

- Interest rates for reverse mortgages typically range from 7.59% to 10.56%.

- These rates are higher than traditional mortgage rates due to the unique nature of reverse mortgages.

Factors Influencing Reverse Mortgage Interest Rates

- Market Conditions: Interest rates can fluctuate based on changes in the broader financial market.

- Loan Type: Fixed-rate loans offer stability, while variable-rate loans can fluctuate.

- Lender Policies: Different lenders may offer varying interest rates based on their risk assessment and market strategy.

Impact of Interest Rates on Borrowing Amount

- Higher interest rates can reduce the amount of money homeowners can borrow.

- Interest accrues over time, increasing the total amount owed when the loan is repaid.

Understanding the interest rates associated with reverse mortgages is crucial for homeowners considering this financial product. It’s essential to compare rates from different lenders and consult with a financial advisor to make an informed decision.

H2: Fees Associated with Reverse Mortgages

While reverse mortgages can provide significant financial benefits, it’s essential to be aware of the associated fees. These can add to the overall cost of the loan and impact the amount of money you receive. Here’s a detailed look at the various fees involved:

Setup and Administrative Fees

- Appraisal Fee: Typically ranges from $300 to $500, depending on the property’s location and value.

- Legal Fees: Costs associated with obtaining independent legal advice and processing the mortgage documents. These can range from $1,000 to $2,000.

- Closing Costs: Additional fees for closing the loan, which can include title insurance, registration fees, and other administrative charges. These can add up to $1,500 or more.

Prepayment Penalties

- Early Repayment Fees: If you decide to pay off your reverse mortgage early, you may incur prepayment penalties. These fees vary between providers and can be a percentage of the outstanding loan balance.

- Interest Rate Differential Penalty: This penalty applies if the interest rates have dropped since you took out the loan and you decide to repay early. It compensates the lender for the difference in interest rates.

Ongoing Costs

- Servicing Fees: Some lenders may charge ongoing servicing fees to manage your loan. These can be monthly or annual charges.

- Interest Accrual: While not a fee per se, it’s essential to understand that interest accrues over time, increasing the total amount owed when the loan is repaid.

Understanding the fees associated with reverse mortgages is crucial for making an informed decision. Homeowners should carefully review all costs and consult with a financial advisor to ensure they fully understand the financial implications.

H2: Receiving Funds from a Reverse Mortgage

One of the key benefits of a reverse mortgage is the flexibility in how you can receive the funds. This allows homeowners to tailor the loan to their specific financial needs and goals.

Lump-Sum Payment

- Description: Receive the entire loan amount upfront in one single payment.

- Best For: Homeowners who need a large sum of money for significant expenses, such as home renovations or medical bills.

Regular Installments

- Description: Receive smaller, scheduled payments over time, similar to a monthly income.

- Best For: Homeowners who need a steady stream of income to supplement their retirement funds.

Combination of Both

- Description: Receive an initial lump-sum payment followed by regular installments.

- Best For: Homeowners who need immediate funds for a specific purpose but also desire ongoing income support.

Example Scenarios

- Scenario 1: A homeowner opts for a lump-sum payment to cover the cost of major home renovations.

- Scenario 2: Another homeowner chooses regular installments to supplement their monthly retirement income.

- Scenario 3: A third homeowner selects a combination of both to address immediate financial needs and ensure ongoing support.

The flexibility in receiving funds from a reverse mortgage allows homeowners to create a financial plan that best suits their needs. Consulting with a financial advisor can help determine the most suitable option.

H2: Pros and Cons of Reverse Mortgages

Understanding the advantages and disadvantages of reverse mortgages is essential for making an informed decision. Here’s an in-depth look at the pros and cons:

H3: Pros

- Access to Home Equity Without Selling: Homeowners can access the equity in their home without the need to sell or refinance.

- No Regular Mortgage Payments Required: Unlike traditional loans, reverse mortgages do not require monthly payments, providing financial relief.

- Tax-Free Money: The funds received are not considered income, so they are tax-free.

- Flexibility in Receiving Funds: Homeowners can choose how they want to receive the funds, whether as a lump sum, regular installments, or a combination of both.

- Ability to Age in Place: Homeowners can stay in their homes while accessing the equity, allowing them to age in place.

- No Negative Equity Guarantee: Homeowners will never owe more than the home’s value at the time of sale.

- Unaffected by OAS/GIS Benefits: Reverse mortgage funds do not affect Old Age Security (OAS) or Guaranteed Income Supplement (GIS) benefits.

H3: Cons

- Higher Interest Rates: Reverse mortgage interest rates are generally higher than traditional mortgage rates.

- Impact on Estate and Inheritance: The loan balance, including interest and fees, must be repaid when the homeowner passes away, potentially reducing the inheritance for heirs.

- Potential for Reduced Home Equity: Over time, the loan balance increases, reducing the equity in the home.

- Fees and Closing Costs: Various fees, including setup, legal, and administrative costs, can add to the overall expense.

- Prepayment Penalties: Early repayment of the loan may incur penalties, adding to the cost.

Understanding the pros and cons of reverse mortgages can help homeowners weigh the benefits against the potential drawbacks. Consulting with a financial advisor and obtaining independent legal advice is crucial for making an informed decision.

H2: How to Apply for a Reverse Mortgage in Canada

Applying for a reverse mortgage in Canada involves several steps. Here’s a step-by-step guide to help you navigate the process:

Step-by-Step Guide to the Application Process

- Initial Consultation: Speak with a mortgage broker or financial advisor to determine if a reverse mortgage is suitable for you.

- Online Estimate: Use an online calculator to get an initial estimate of how much you can borrow.

- Detailed Assessment: Provide detailed information about your age, home’s location, condition, and current value for a comprehensive assessment.

- Submit Application: Complete and submit the reverse mortgage application form.

- Home Appraisal: An appraisal is conducted to determine the current market value of your home.

- Legal Consultation: Obtain independent legal advice to review the terms and conditions of the loan.

- Loan Approval: Once approved, you will receive the loan documents for signing.

- Receiving Funds: Choose how you want to receive the funds (lump sum, regular installments, or combination).

Required Documentation

- Proof of age (e.g., birth certificate, passport)

- Proof of homeownership (e.g., title deed)

- Proof of residence (e.g., utility bills)

- Recent property tax statement

- Home insurance policy

Role of a Mortgage Broker

- Guidance: Mortgage brokers provide expert guidance throughout the application process.

- Comparison: They can compare different reverse mortgage products and interest rates from various lenders.

- Support: Brokers assist with paperwork, negotiations, and obtaining the best terms.

Importance of Independent Legal Advice

- Understanding Terms: Legal advisors help you understand the terms and conditions of the loan.

- Protecting Interests: They ensure that your interests are protected and that you fully understand the financial implications.

- Compliance: Legal advice is required to comply with Canadian regulations.

Applying for a reverse mortgage involves careful consideration and consultation with professionals. By following these steps and obtaining the necessary documentation, homeowners can navigate the application process smoothly.

H2: How Do You Repay a Reverse Mortgage?

Repaying a reverse mortgage is different from repaying a traditional mortgage. Understanding the repayment process is crucial for homeowners considering this financial product. Here’s an in-depth look at how repayment works:

When Repayment is Required

- Sale of Home: The loan must be repaid when the home is sold.

- Permanent Move: If the homeowner moves out permanently (e.g., to a nursing home), the loan becomes due.

- Death of the Homeowner: The loan must be repaid from the proceeds of the estate when the homeowner passes away.

Options for Repayment

- Selling the Home: The most common method of repayment is selling the home. The proceeds from the sale are used to repay the loan balance, including interest and fees.

- Using Other Assets: If the homeowner or their heirs have sufficient assets, they can repay the loan without selling the home.

- Refinancing: In some cases, refinancing the home with a traditional mortgage or home equity loan may be an option to repay the reverse mortgage.

What Happens if the Loan Amount Exceeds the Home Value

- No Negative Equity Guarantee: Most reverse mortgages in Canada come with a no negative equity guarantee. This means that homeowners will never owe more than the home’s value at the time of sale.

- Lender Absorbs the Loss: If the loan amount exceeds the home’s value, the lender absorbs the loss. The homeowner or their heirs are not responsible for the shortfall.

Example Scenarios

- Scenario 1: A homeowner sells their home for $500,000. The outstanding reverse mortgage balance, including interest and fees, is $300,000. The loan is repaid from the sale proceeds, and the homeowner or their heirs receive the remaining $200,000.

- Scenario 2: A homeowner passes away, and the home is valued at $400,000. The outstanding loan balance is $450,000. Due to the no negative equity guarantee, the lender absorbs the $50,000 loss, and the heirs are not responsible for the shortfall.

Understanding the repayment process and options for a reverse mortgage is essential for homeowners and their heirs. Consulting with a financial advisor and obtaining legal advice can help navigate this process smoothly.

H2: Avoiding Scams in Reverse Mortgages

Reverse mortgages can be a valuable financial tool, but it’s essential to be aware of potential scams. Here are some tips to avoid falling victim to reverse mortgage scams:

Seek Out Reverse Mortgages Independently

- Do Your Research: Research reverse mortgage providers and products independently. Avoid unsolicited offers or high-pressure sales tactics.

- Use Reputable Sources: Use reputable sources such as HomeEquity Bank and Equitable Bank to find information and apply for reverse mortgages.

Work with Licensed, Experienced Brokers

- Check Credentials: Ensure that the mortgage broker you work with is licensed and has experience with reverse mortgages.

- Get Recommendations: Ask for recommendations from trusted friends, family, or financial advisors.

Ensure Terms and Conditions are in Writing

- Read the Fine Print: Carefully read all terms and conditions of the reverse mortgage. Ensure that everything is clearly outlined in writing.

- Ask Questions: Don’t hesitate to ask questions if anything is unclear. A reputable lender or broker will be happy to explain.

Be Cautious of Unnecessary Fees and Personal Information Requests

- Avoid Upfront Fees: Be wary of lenders or brokers who ask for upfront fees before processing your application.

- Protect Personal Information: Only provide personal information to reputable lenders and brokers. Avoid sharing sensitive information over the phone or email unless you are sure of the recipient’s legitimacy.

By following these tips, homeowners can avoid scams and ensure they are working with reputable lenders and brokers. Consulting with a financial advisor and obtaining independent legal advice can also provide additional protection.

H2: Frequently Asked Questions About Reverse Mortgages in Canada

H3: Can You Get a Reverse Mortgage if You Already Have a Mortgage?

Yes, you can get a reverse mortgage even if you already have a mortgage. However, the existing mortgage must be paid off with the proceeds from the reverse mortgage. The remaining funds can then be used for other purposes.

H3: What Happens if the Homeowner Passes Away?

When the homeowner passes away, the reverse mortgage becomes due. The loan is typically repaid from the proceeds of the home sale. If the home’s value exceeds the loan balance, the remaining funds go to the homeowner’s heirs. If the loan balance exceeds the home’s value, the lender absorbs the loss due to the no negative equity guarantee.

H3: Can You Lose Your Home with a Reverse Mortgage?

As long as you meet the terms of the reverse mortgage, such as maintaining the home and paying property taxes and insurance, you cannot lose your home. However, failure to meet these terms can result in the loan becoming due, which may lead to the sale of the home.

H3: Are Reverse Mortgage Funds Taxable?

No, the funds received from a reverse mortgage are not considered income and are therefore tax-free. This can be a significant advantage for retirees looking to supplement their income without increasing their tax burden.

H3: How Does a Reverse Mortgage Affect Government Benefits?

Reverse mortgage funds do not affect Old Age Security (OAS) or Guaranteed Income Supplement (GIS) benefits. This allows homeowners to access additional funds without impacting their government benefits.

H3: Downsides of Reverse Mortgages

- High Interest Rates: Reverse mortgage interest rates are typically higher than traditional mortgage rates.

- Multiple Fees: There are various fees associated with reverse mortgages, including setup, legal, and administrative costs.

- Prepayment Penalties: Early repayment of the loan may incur penalties, adding to the overall cost.

H3: Interest Rates on Reverse Mortgages

Interest rates on reverse mortgages typically range from 7.59% to 10.56%. These rates are higher than traditional mortgage rates due to the unique nature of reverse mortgages and the lack of regular payments.

Understanding the frequently asked questions about reverse mortgages can help homeowners make informed decisions. Consulting with a financial advisor and obtaining independent legal advice can provide additional clarity and confidence.

H2: Alternatives to Reverse Mortgages

While reverse mortgages can be a valuable financial tool, they are not the only option available to homeowners. Here are some alternatives to consider:

Home Equity Line of Credit (HELOC)

- Description: A HELOC allows homeowners to borrow against the equity in their home, similar to a reverse mortgage but with the requirement of regular payments.

- Pros: Lower interest rates compared to reverse mortgages, flexibility in borrowing and repayment.

- Cons: Requires regular payments, which may not be suitable for those on fixed incomes.

Downsizing

- Description: Selling the current home and purchasing a smaller, more affordable property.

- Pros: Frees up significant equity, reduces maintenance and living costs.

- Cons: Requires moving, which may not be desirable for all homeowners.

Selling and Renting

- Description: Selling the home and moving into a rental property.

- Pros: Provides a lump sum of cash, eliminates home maintenance responsibilities.

- Cons: Loss of homeownership, potential rent increases over time.

Taking on a Tenant

- Description: Renting out a portion of the home to generate additional income.

- Pros: Provides a steady stream of income, retains homeownership.

- Cons: Requires sharing living space, potential issues with tenants.

Applying for a Home Equity Loan

- Description: Borrowing against the equity in the home with a traditional home equity loan.

- Pros: Lower interest rates compared to reverse mortgages, fixed repayment schedule.

- Cons: Requires regular payments, which may not be suitable for those on fixed incomes.

Selling Other Investments

- Description: Liquidating other investments, such as stocks or bonds, to generate cash.

- Pros: Provides immediate funds, avoids taking on additional debt.

- Cons: May incur taxes or penalties, reduces investment portfolio.

Each alternative to reverse mortgages comes with its own set of advantages and disadvantages. Homeowners should carefully consider their financial needs and consult with a financial advisor to determine the best option.

H2: Real-Life Examples of Reverse Mortgages in Canada

Understanding how reverse mortgages work in real-life scenarios can provide valuable insights for homeowners considering this financial product. Here are some case studies and testimonials from Canadian homeowners who have benefited from reverse mortgages.

Case Study 1: John and Mary’s Home Renovation

- Background: John and Mary, both in their late 60s, own a home valued at $600,000 in Toronto. They needed funds to renovate their home to make it more accessible as they age.

- Solution: They opted for a reverse mortgage and borrowed $300,000 (50% of the home’s value).

- Outcome: The funds allowed them to complete the necessary renovations without taking on monthly mortgage payments. They received the money as a lump sum and used it to install a stairlift, renovate the bathroom, and make other accessibility improvements. They now enjoy their newly renovated home without the financial burden of regular payments.

Case Study 2: Susan’s Supplemental Income

- Background: Susan, a 75-year-old widow living in Vancouver, needed additional income to cover her living expenses. Her home is valued at $800,000.

- Solution: She opted for a reverse mortgage and chose to receive regular monthly installments. She borrowed $400,000 (50% of the home’s value) and set up a plan to receive $2,000 per month.

- Outcome: The monthly installments provided Susan with a steady stream of income, allowing her to cover her living expenses comfortably. She continues to live in her home and enjoys financial stability without the need to sell her property.

Case Study 3: Tom and Lisa’s Travel Dreams

- Background: Tom and Lisa, both aged 70, wanted to travel the world during their retirement years. Their home in Calgary is valued at $500,000.

- Solution: They opted for a reverse mortgage and borrowed $250,000 (50% of the home’s value). They chose a combination of an initial lump-sum payment and regular installments.

- Outcome: The initial lump-sum payment allowed them to book their dream vacation, and the regular installments provided extra income for their ongoing travel expenses. They have since traveled to several countries and continue to enjoy their retirement without financial stress.

Testimonials from Canadian Homeowners

- David and Margaret: “The reverse mortgage allowed us to stay in our home and enjoy our retirement. We were able to access the funds we needed without the burden of monthly payments.”

- Linda: “I was hesitant at first, but the reverse mortgage has been a lifesaver. It provided the financial flexibility I needed to make necessary home repairs and cover my living expenses.”

- Richard: “The reverse mortgage gave us the freedom to travel and enjoy our retirement years. We didn’t want to sell our home, and this was the perfect solution.”

These real-life examples and testimonials highlight the diverse ways in which reverse mortgages can benefit Canadian homeowners. By providing access to home equity without the need to sell or refinance, reverse mortgages offer financial flexibility and peace of mind.

H2: Legal and Financial Considerations

Before finalizing a reverse mortgage, it’s essential to consider the legal and financial aspects. Understanding these considerations can help homeowners make informed decisions and protect their interests.

Importance of Getting Legal Advice

- Understanding Terms: Legal advisors help homeowners understand the terms and conditions of the reverse mortgage.

- Protecting Interests: They ensure that the homeowner’s interests are protected and that they fully understand the financial implications.

- Compliance: Legal advice is required to comply with Canadian regulations and ensure that the homeowner is making an informed decision.

Understanding the Reverse Mortgage Contract

- Loan Terms: Review the loan terms, including the interest rate, fees, and repayment conditions.

- No Negative Equity Guarantee: Ensure that the contract includes a no negative equity guarantee, protecting the homeowner from owing more than the home’s value.

- Prepayment Penalties: Understand any prepayment penalties that may apply if the loan is repaid early.

Long-Term Financial Planning

- Impact on Estate: Consider the impact of the reverse mortgage on the homeowner’s estate and inheritance for heirs.

- Financial Goals: Align the reverse mortgage with long-term financial goals and retirement plans.

- Consult with Advisors: Work with financial advisors, mortgage brokers, and legal professionals to create a comprehensive financial plan.

Legal and financial considerations are crucial for homeowners considering a reverse mortgage. By seeking professional advice and understanding the terms and conditions, homeowners can make informed decisions that align with their financial goals and protect their interests.

Conclusion

Reverse mortgages can be a valuable financial tool for Canadian homeowners aged 55 and older. By allowing homeowners to access the equity in their homes without the need to sell or refinance, reverse mortgages provide financial flexibility and stability during retirement years. However, it’s essential to understand the pros and cons, fees, interest rates, and legal and financial considerations before making a decision.

Summary of Key Points

- What is a Reverse Mortgage? A loan that allows homeowners to convert home equity into cash without selling the home.

- Eligibility: Homeowners must be 55 years or older and meet specific homeownership and value requirements.

- Borrowing Limit: Up to 55% of the home’s current value, depending on various factors.

- Interest Rates and Fees: Higher interest rates compared to traditional mortgages, with various associated fees.

- Repayment: The loan is repaid when the home is sold, the homeowner moves out permanently, or passes away.

- Alternatives: Consider other options such as HELOC, downsizing, selling and renting, or taking on a tenant.

Final Thoughts

Reverse mortgages can be beneficial for certain financial situations but come with risks and costs that should be carefully considered. Homeowners should consult with financial advisors, mortgage brokers, and legal professionals to ensure they fully understand the implications and make informed decisions.

Call to Action

- Learn More: For more information on reverse mortgages, visit HomeEquity Bank and Equitable Bank.

- Share: If you found this article helpful, please share it with others who may benefit from the information.

- Contact: For further inquiries or consultations, contact a licensed mortgage broker or financial advisor.

Internal Links

External Links

Additional Resources

- Downloadable guides or checklists

- Contact information for mortgage brokers and financial advisors

- Links to government resources on reverse mortgages in Canada